When you are starting out, the cost of getting set up and started with an accounting or invoicing system might not be part of your budget. Or, you might want to control how you are doing it at the beginning, until you get your head around what you need.

Either way, creating your invoice template with Microsoft Word is a great starting point. This post breaks down the eight (yep, 8) elements that every Australian business invoice is required to contain, so you can create your document with confidence. So let's get started.

Introduction to invoices - what are they?

In its simplest terms, an invoice is a request for payment. Invoices are documents that outline the goods or services you have supplied to your client, and what they owe you in return for that supply.

You should know that invoices are also considered tax documents. You are required to keep copies of the invoices you send out, to show what you have earned (and any tax you collected), as well as any invoices you have paid to show what you have spent. In this post, we are focussed on getting the invoices you send out set up correctly, so that you won't have any issues at tax time, or with your client not knowing what to do when you send them your invoice!

The eight elements every invoice needs

According to the Australian Taxation Office (ATO), the requirements for your invoices are split into two categories: invoices for sales under $1,000, and invoices for sales over $1,000. There are seven elements that invoices under $1,000 must contain. Invoices over $1,000 must contain these same seven elements, with an additional requirement (making the eight total elements).

While that eighth element is not a requirement if you raise an invoice up to $999, I would personally recommend setting up your template so that it includes all eight from the start. This way, you won't have to worry about having to make changes to the layout each time (or forgetting to update it when you need to!).

1. Clearly labelled as an invoice / tax invoice

Like most documents, your invoice needs to have a title. In this case, it's a clear sign that the document you are sending to a client is an invoice (request for payment), so there can be no confusion.

- If you are registered for GST, and claiming GST on your invoices, you are required to use the title Tax Invoice.

- If you are not registered for GST, and do not claim GST on your invoices, you are required to use the title Invoice.

Invoice/Tax Invoice headings should be clear and prominent at the top of the page. It is best to avoid using script font for this title (but feel free to use one of your brand colours!).

2. The seller's (that's you, the business owner issuing the invoice) identity

This should be your full business name (the legal name). If you are a company, then that will be your company name. If you are a sole trader, or use a business name as a sole trader, you would put something like:

Your Name trading as Business Name

- Marianne Tansley trading as Thrive Admin Services, OR

- Marianne Tansley

Thrive Admin Services

You also need to include your Australian Business Number (or ABN) as part of identifying yourself. An ABN is a 11 digit number that identifies your business. It's issued to you when you register your company, or when you apply for one as a sole trader. If you aren't sure of what your ABN is, you can find it online using ABN Lookup.

3. A unique invoice number

Every invoice needs to have it's own unique identifier. You can't just give everyone INV001 🤣 There are lots of ways to identify your invoices. Some people use INV-XXX. Others simply use the client's name and a number (e.g. THRIVE001). This is particularly useful if you have repeat clients, and you want to be able to search for all of that particular client's invoices in one place.

Whatever system you use, you need to also keep track of the numbers allocated somewhere (I use an excel spreadsheet). A simple log for invoice numbers, using whatever system you decide on, will help you track the invoice number, who it goes to, and what amount you have invoiced them for, so you never end up sending out different invoices with the same invoice number!

If you are looking for a handy way to track this info, check out the Thrive Business Income Tracking Tool.

4. The date the invoice was issued

This is the date that the invoice is ready to be sent. This date should also be the date you send the invoice to the client. If sending via email, the client will receive it the same day you send it. If you are sending a hard copy in the post, there will be a discrepancy between the invoice date and the date the client receives it.

5. A description of the goods or services provided

This is where you break down what this invoice is requesting payment for. A good invoice has a clear layout in this section, so that it's easy to understand what is being requested. You should include a brief description of the items/services, the quantity sold (if applicable), and the price.

When creating your template in Microsoft Word, you can set this section up as a table (with or without gridlines), or as bullet points in a list. Make sure that your font size and colour are easy to read (both on the screen and printed), and your descriptions are clear and concise.

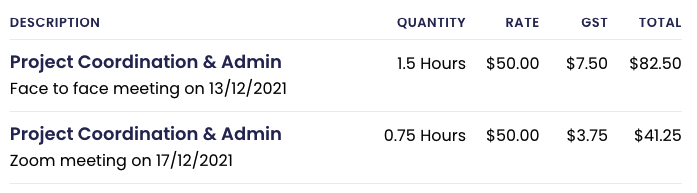

If you have multiple quantities of an item (like several hours at an hourly rate for a particular description), you can provide a 'subtotal' so that the client can easily see what they have received:

6. The GST amount (if applicable)

This one is for those of you who are registered for GST. If you aren't, you can skip on to the next element 🤓

When listing the GST on your invoice, you have a couple of options:

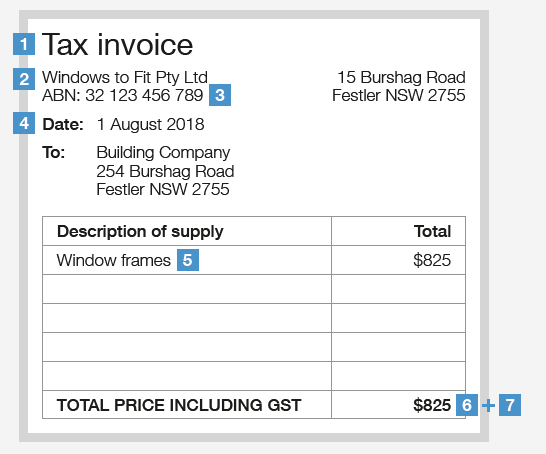

- If the GST of the invoice is exactly one-eleventh (1/11) of the total price, you can simply list the total price of the invoice, and include a statement that says 'Total price includes GST' clearly on the invoice near the total.

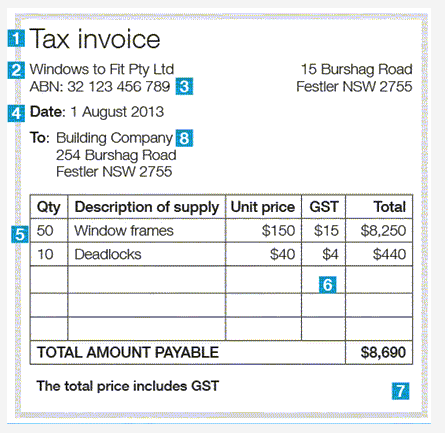

- Individual line item totals, with a breakdown of the GST for that line item.

Examples of each are shown below:

|

|

7. The extent to which the sale is a taxable sale

Generally speaking, a taxable sale is any item you are selling (or requesting payment for) that has GST in the price. So again, if you aren't registered for GST, this won't apply to you 😊

To be a taxable sale, that sale must be:

- for a payment of some description, AND

- be made in the course of operating your business, AND

- be connected with Australia.

When you make a taxable sale, you must:

- include GST in the price, AND

- issue a tax invoice to the purchaser, AND

- pay the GST component of the invoice to the ATO when lodging your activity statement (consult your accountant on this process!).

In the examples in the section above, where you state 'Total price including GST', you are declaring the taxable sale on your invoice.

You can learn more about taxable sales via the ATO's website here.

8. The buyer's identity or ABN

Now, this last element is only a requirement for invoices of $1,000 or more, but I think it's a great habit to get into for all of your invoices for two reasons.

- Save time: the template you create doesn't need to have the layout edited, regardless of the amount you are invoicing for.

- Professionalism: an invoice that is made out to your client, by name (with or without their ABN) looks more professional, and helps your client recognise you as the expert you are (and that's what it's all about, right?!)

So where to from here?

Firstly, I know that there is a lot of information up there. So take your time, and come back to this post as often as you need to.

If you want more information about what you need to include in your invoice templates, then I recommend that you chat to your accountant. If you don't have one, or want to do some research yourself, then check out the ATO website, or business.gov.au.

When you are ready to take the plunge and create your own invoices, I absolutely recommend using either Excel or Word in the Microsoft suite. Both programs have a great range of templates you can download and edit to suit your needs. It's really about personal choice as to whether you prefer a spreadsheet (where you can add all the formulas!), or a word document (where, surprisingly, you can also add a couple of formulas to make your life easier!)

There are also loads of awesome examples online of invoices. Check out Pinterest or Google search to get a feel for what they can look like.

Whichever program you use to make your invoice template, remember to brand it up! Add your logo, and use your branding colours and fonts to reinforce your brand messaging to clients. It's another opportunity to make an impression, so make it a good one!

Lastly, if you would like a hand to get started, then Thrive has you covered. Our Invoice templates are Microsoft Word documents, that you can customise to suit your brand and business needs. We have a template that includes GST, and one that doesn't, so you can get the exact elements you need. You can get more details by clicking one of the buttons below.

Thrive's DIY Invoice Template (no GST) Thrive's DIY Invoice Template (GST)

Share the love

Like this post? Know someone else who might benefit from it? Then we'd love you to share it with your network! The more people we can help with info like this, the better!

If you enjoyed this post, then let me know! Add a comment here, or get in touch directly - you can email me, or find me hanging out on Facebook, Instagram and LinkedIn (search Thrive Admin Services).

Thrive is a fan of Microsoft 365

Thrive recommends Microsoft 365 Business, which includes Word, Excel, Outlook, Sharepoint, OneDrive, Planner and a heap of other awesome apps. If I've worked with you, chances are you've seen some of what I use to run Thrive through 365. It's come a long way from when I first started working with Word and Excel! These days, I have seamless access to all of my work no matter where I am!

If you would like to know more, you should definitely do your own research to see if it's suitable for you. You can compare the Microsoft 365 for business plans here

**Disclaimer - Thrive is a Microsoft Affiliate, and if you choose to purchase via the above link, I may receive a small commission. You can read Thrive's full affiliate disclosure policy here.

**Disclaimer: all information here is based on working with a Microsoft 365 subscription. If you are working with an older version of Microsoft, some of this information may not be relevant to you. Screenshots provided from the desktop version of Microsoft 365 programs in posts are taken from a Mac, so may appear different for PC users. Wherever possible, links to alternate information sources are provided to ensure all readers have access to content that is appropriate for their situation.

Comments